Forex Brokers: Safeguard and Reliable Alternatives for Traders

Forex Brokers: Safeguard and Reliable Alternatives for Traders

Blog Article

Decoding the Globe of Foreign Exchange Trading: Revealing the Importance of Brokers in Taking Care Of Threats and Guaranteeing Success

In the detailed world of foreign exchange trading, the duty of brokers stands as a pivotal aspect that often remains shrouded in enigma to lots of hopeful traders. The intricate dance in between investors and brokers introduces a symbiotic partnership that holds the crucial to unwinding the secrets of profitable trading ventures.

The Duty of Brokers in Foreign Exchange Trading

Brokers play a critical function in forex trading by providing crucial services that help investors take care of risks successfully. These monetary middlemans serve as a bridge between the investors and the forex market, supplying a series of solutions that are essential for browsing the complexities of the forex market. Among the main functions of brokers is to supply traders with accessibility to the market by promoting the implementation of professions. They provide trading platforms that permit investors to get and market money sets, supplying real-time market quotes and guaranteeing quick order execution.

In addition, brokers use educational sources and market evaluation to aid investors make informed choices and create effective trading approaches. Generally, brokers are essential partners for investors looking to browse the foreign exchange market efficiently and handle threats effectively.

Risk Administration Approaches With Brokers

Offered the crucial duty brokers play in assisting in access to the foreign exchange market and providing risk administration devices, comprehending efficient strategies for managing threats with brokers is vital for successful foreign exchange trading. By spreading out financial investments throughout various money pairs and property classes, investors can decrease their exposure to any type of single market or tool. Maintaining a trading journal to track performance, analyze previous trades, and identify patterns can assist investors refine their methods and make more educated decisions, eventually enhancing risk management practices in forex trading.

Broker Selection for Trading Success

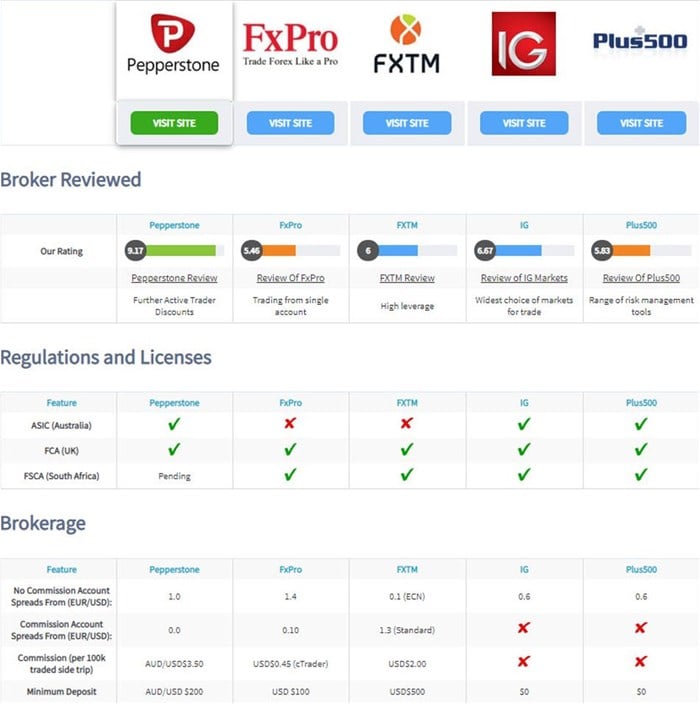

Selecting the right broker is vital for attaining success in forex trading, as it can dramatically affect the total trading experience and outcomes. Functioning with a controlled broker gives a layer of safety for traders, as it guarantees that the broker operates within set standards and guidelines, thus decreasing the threat of fraudulence or malpractice.

Furthermore, investors need to evaluate the broker's trading platform and tools. An easy to use platform with sophisticated charting devices, quickly profession execution, and a variety of order kinds can boost trading efficiency. Checking out the broker's client assistance solutions is important. Prompt and reliable customer assistance can be indispensable, specifically throughout unstable market problems or technical issues.

Furthermore, traders should examine the broker's cost framework, including spreads, commissions, and any kind of hidden fees, to recognize the expense ramifications of trading with a certain broker - forex brokers. By meticulously evaluating these aspects, investors can select a broker that aligns with their trading goals and establishes the phase for trading success

Leveraging Broker Expertise for Earnings

How can traders effectively harness the competence of their chosen brokers to take full advantage of success in foreign exchange trading? Leveraging broker know-how for revenue calls for a tactical strategy that involves understanding and making use of the solutions supplied by the broker to boost trading results. One vital way to leverage broker competence is by making the most of their research study and evaluation tools. Many brokers supply accessibility to market insights, technological evaluation, and economic calendars, which can assist investors make informed decisions. By remaining notified about market fads and events through the broker's resources, investors can determine lucrative chances and reduce threats.

In addition, investors can gain from the guidance and assistance of knowledgeable brokers. Developing a good connection with a broker can lead to individualized advice, profession suggestions, and threat management strategies customized to private trading styles Bonuses and goals. By connecting frequently with their brokers and seeking input on trading strategies, investors can take advantage of expert understanding and boost their general performance in the foreign exchange market. Eventually, leveraging broker proficiency for revenue involves energetic engagement, constant knowing, and a collaborative strategy to trading that makes best use of the capacity for success.

Broker Aid in Market Evaluation

Broker assistance in he has a good point market evaluation prolongs beyond simply technical analysis; it likewise includes fundamental analysis, belief evaluation, and danger monitoring. By leveraging their proficiency and access to a large range of market information and research study tools, brokers can help investors browse the complexities of the foreign exchange market and make educated decisions. In addition, brokers can give prompt updates on economic occasions, geopolitical developments, and various other elements that may impact money costs, making it possible for investors to stay ahead of market variations and change their trading positions accordingly. Inevitably, by using broker assistance in market evaluation, traders can improve their trading performance and raise their opportunities of success in the affordable forex market.

Verdict

Finally, brokers play a critical function in foreign exchange trading by managing threats, supplying proficiency, and assisting in market analysis. Selecting the best broker is important for trading success and leveraging their knowledge can lead to revenue. forex brokers. By using risk monitoring strategies and functioning very closely with brokers, traders can navigate the complex globe of foreign exchange trading with self-confidence and enhance their chances of success

Provided the critical function brokers play in facilitating accessibility to the foreign exchange market and providing danger monitoring tools, understanding efficient approaches for managing dangers with brokers is important for successful foreign exchange trading.Selecting the best broker is vital for attaining success in foreign exchange trading, as it can my response significantly impact the general trading experience and end results. Functioning with a controlled broker offers a layer of safety for investors, as it makes certain that the broker operates within set guidelines and criteria, hence reducing the risk of fraudulence or negligence.

Leveraging broker expertise for earnings needs a calculated strategy that involves understanding and making use of the solutions supplied by the broker to enhance trading results.To properly capitalize on broker proficiency for earnings in forex trading, traders can count on broker assistance in market analysis for informed decision-making and threat mitigation approaches.

Report this page